Helping businesses earn more, pay less tax, allowing you to live the life you want

Chartered Accountants on the outskirts of York

Chartered Accountants in York

As business owners ourselves we know the frustration, stress, and sleepless nights caused by running a business, managing a team, and keeping track of what taxes are due.

At Inglis, we save you time, stress and money by helping you stay in control of your business and maximising your tax reliefs. We are more than just an accounting firm, we support you and your business in the long term, and help you achieve your business and life goals.

Net Zero Accounting

Inglis have proudly reached the first level of certification to becoming a Net Zero business, working with climate action platform, Net Zero Now.

Popular services

At Inglis, we offer a range of accounting services to help your business grow and thrive

Virtual Finance Director

Leave us to manage the finance function of your business so you can concentrate on the day-to-day running of your business. As your Virtual Finance Director, we will be a sounding board you can bounce ideas off, as well as acting as your business coach and working alongside you to ensure you meet your business goals.

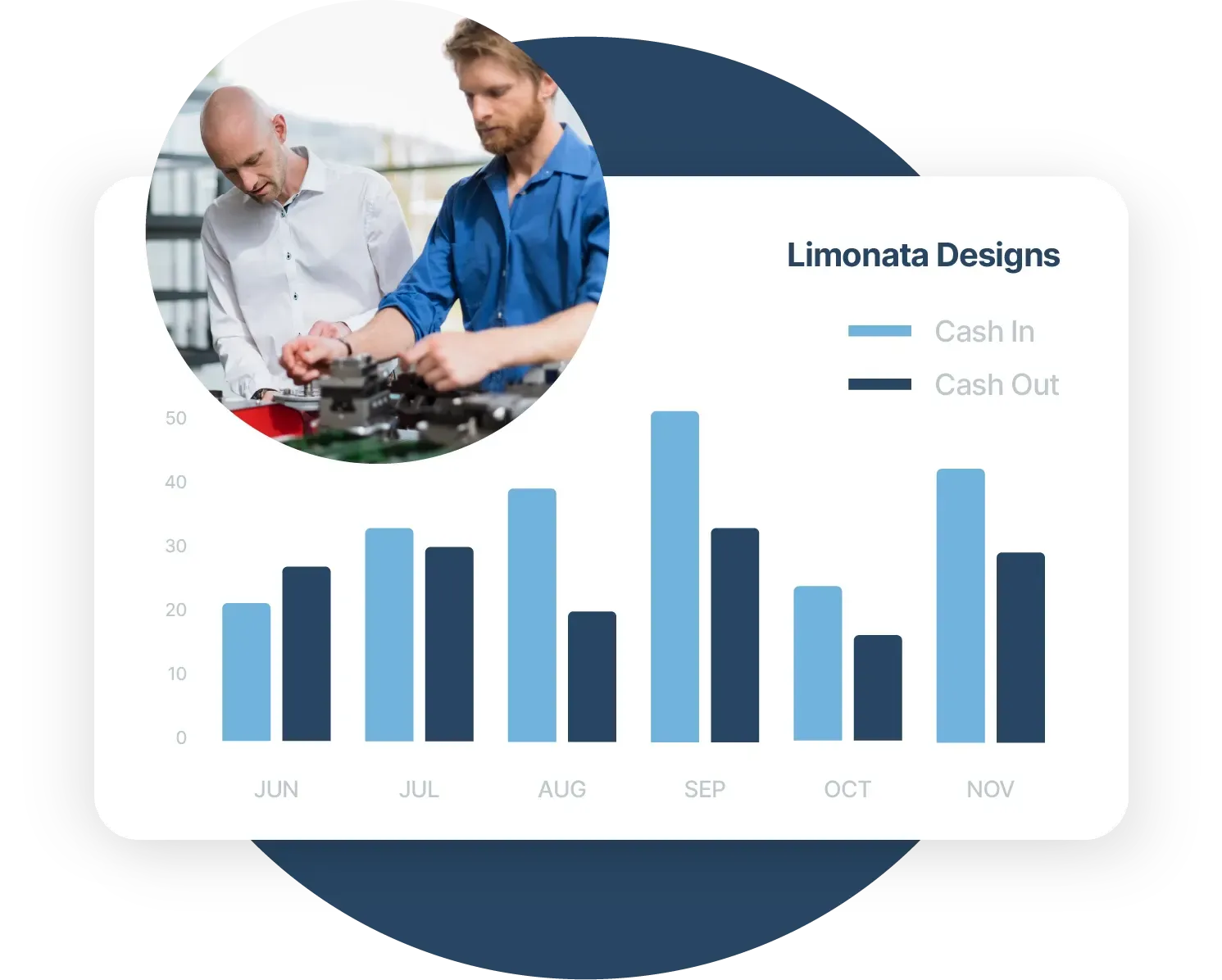

Management Accounts

Do you know how much money is coming in and going out of your business on a day by day, week by week basis? In order that you can make informed decisions to manage your business better, we offer a management accounts service that will help you keep on track of your company's numbers.

Bookkeeping

As you grow your business the number of transactions you complete can quickly add up and bookkeeping can become a daunting and endless task. We offer an out of house bookkeeping service so all you need to do is pass us your sales invoices and receipts and we will do the rest.

FREE DOWNLOAD

32 Ways To Save Tax and Extract Maximum Value From Your Business

Ever wonder what you can take out of your business or how you can save more tax? This guide explores 32 ways of ensuring that you’re maximising every opportunity you could be to improve your life, your families and your employees.

Latest Blog Articles